Retail investors uniting on Reddit have boosted shares of games retailer Gamestop. While speculation professionals lost billions, a YouTuber made a fortune with GME.

YouTuber is now 46 times a millionaire

Robinhood: The tool of many US retail investors

This is behind the price explosion of Gamestop shares

Actually, Gamestop is just a retail chain for games and entertainment software, which suffers badly from the internet and smartphones. Despite this, the stock is up 900 percent since the beginning of 2021. We explain the background of the price explosion.

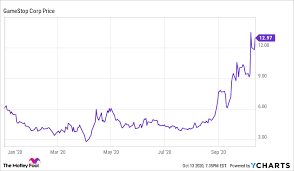

Gamestop stock up 4,500 percent since early 2020

If you look at the most popular shares at online brokers like Trade Republic , you will find the Gamestop share there almost continuously since the beginning of 2021.

The price has increased by almost 900 percent since the beginning of January 2021 – from 14 euros to 190 euros. The increase is even clearer compared to spring 2020. The price there was just 2.80 euros. This corresponds to an increase of around 4,500 percent.

Why is Gamestop Stock Rising So Much?

That’s a question that shareholders around the world have been asking themselves more and more over the last few days and weeks. Basically, there are several answers and possible explanations.

What does a short seller do?

On the one hand there are so-called short sellers. You bet that the price of a stock will fall. That is why they make so-called short sales. That is, the short sellers borrow shares and sell them at a certain price with the hope of buying them back later at a lower price.

In the case of the Gamestop share, for example, the large short seller Citron Research around boss Andrew Left has issued a sell recommendation.

Left had quite a few arguments. The pressure on Gamestop has increased steadily in recent years. Online and mobile games have hit brick-and-mortar retailers like Gamestop hard, pushing them to the brink of bankruptcy.

How young traders on Reddit and Co. work against short sellers

On the other side are investors. Or to be more precise: young investors who rely on free brokers like Robinhood for rising prices. The special thing about it is that these speculators meet in Reddit forums and thus buy in large numbers in a targeted manner and at the same time.

In particular, 2.7 million members plays a crucial role. According to information from the economic service Bloomberg , this type of trader is responsible for 20 percent of trading on the US stock exchange. The impact is correspondingly large.

What is a short squeeze?

This question is at the center of the price explosion in Gamestop shares. By definition , a short squeeze is “the shortage of supply in a security that has previously been sold short (“shorted”) in large numbers.”

So the massive buys by Robinhood and Reddit traders are forcing big short sellers like Citron Research to close their short positions by buying the stock. After all, every cent that goes up means a loss for short sellers.

Due to the forced purchases of the short sellers, the share price then rises again.

Why is the Gamestop Stock Hype So Dangerous?

So far, the story sounds like an interesting business model for laypeople. However, exactly the opposite is the case. The risk with such planned bets against the stock exchange is gigantic.

No one can guarantee a young investor that the Reddit community’s plan will work. However, if this plan fails, young adults in particular may lose their entire capital. This has already led young traders to suicide in the USA .

It is also unclear how long a share will continue to rise. If you get in at the wrong time, you may also be confronted with a total loss. It is therefore advisable not to blindly and ignorantly invest your entire fortune in hypes.

Leave a Reply