When it comes to investments, people are very skeptical. Every investor in the world weighs the pros and cons and the credibility of an investment before putting their money in it. Investments are all about risk-taking, but most investors want their money to be secured and in good hands.

This is why when it comes to investing in new businesses, outside investors who are not the actual owners of the company are quite hesitant to invest. But for someone who needs funding for a startup, approaching investors so that they can acquire a good amount of funding for their business is very important.

Not all investors are alike – where some investors may be looking for long-term investments and safe returns, some investors appreciate the market risk and are always looking for something exciting and new to invest in and may invest in startups.

Steps to find Funding for Startups

For a businessman who is looking for funding for their startup, especially if it’s a sole proprietorship and if it’s a first and new business for the entrepreneur, the process can be quite confusing, draining and taxing. Finding investment for every stage of business is quite tough, let alone in the beginning phase where the entrepreneur has just set up shop.

For first-time businessmen who are looking for funding for a startup business, there are limited but potential ways to kick start the financing process. Many internet organizations and forums work online with small-scale or medium-scale businesses by helping them source funds for their startup.

These non-profit organizations can help create a favorable business plan, pitch the right way to the investors, approach the right investors etc. They can help establish a good financing and investment plan for every stage of business for a startup.

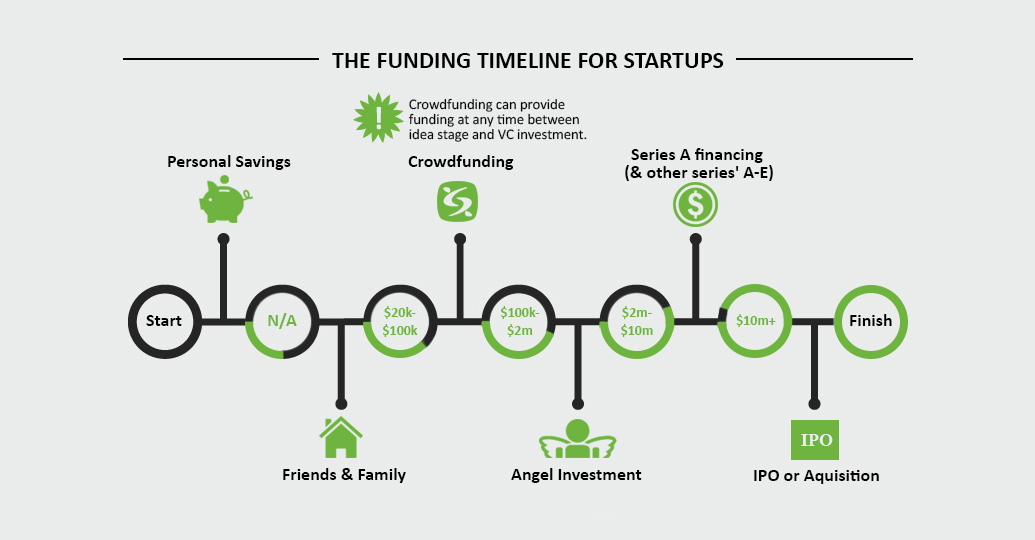

To find the right funding for startups, meaning the right investors who would be interested in investing in a startup, one must know the right people to contact. Below are a few steps to finding the right investors:

1.Angel Investors

Angel Investors are high-net-worth Individuals such as major company owners, investors on wall street and other major stock traders. These individuals are always looking to encourage small-time businesses and help out new entrepreneurs by investing in their business for some returns that are mutually agreed upon by the parties.

They are one of the best bets for new-age entrepreneurs setting up small startups in today’s world as angel investors always look for bright and potential businesses to promote.

2. Venture Capitalists

Venture Capitalists are usually part of a large board in an association or a group of people who invest in startups and new businesses for an equity stake in the startup. They may demand shares, stakes, returns or dividends however they want and, based on the mutual negotiations, are willing to invest either individually or via the board as a group in a startup.

3.Banks and Private Lenders

Banks and Private lenders are perfect for stages of production and expansion that require additional funding now and then. With some collateral or credible banking history, startups can easily acquire small-time loans from banks or private lenders at a rate of interest. They are low risk plus are based on the company’s assets or collateral, therefore less liability for the entrepreneur, unlike angels and VCs.

Leave a Reply