Bitcoin is an experimental ownership transfer and verification system based on a peer-to-peer network without any central authority.

The initial application and main innovation of the Bitcoin network is a decentralized digital currency whose unit of account is bitcoin.

Bitcoin works with software and a protocol that allows participants to issue bitcoins and manage transactions collectively and automatically. As a free protocol ( open source code ), it also allows interoperability of software and services that use it. As a currency, bitcoin is both a payment intermediary and a store of value.

Bitcoin is designed to self-regulate. The Bitcoin System’s limited inflation is evenly distributed by computing power across the network, and will be limited to 21 million divisible units to eight decimal places. The proper functioning of the exchanges is guaranteed by a general organization that everyone can examine, because everything is public there: the basic protocols, the cryptographic algorithms used, the programs making them operational , the data of the accounts and the debates of the developers .

Possession of bitcoins is materialized by a series of numbers and letters which constitute a virtual key allowing the bitcoins associated with it to be spent on the register. A person can hold several keys gathered in a ” Bitcoin Wallet “, a web, software or hardware “keychain” that allows access to the network in order to carry out transactions. The key fob allows to consult the balance in bitcoins and the public keys intended to receive payments. It also contains (often in encrypted form) the private keys associated with these public keys. These private keys must be kept secret, as their holder can spend the bitcoins associated with them on the ledger. Any medium (key ring) is suitable for keeping the series of symbols that make up your key ring : paper, USB key, memory, etc. Thanks to adequate software , you can manage your assets on your computer or your telephone.

To have bitcoins in an account, you must either have a bitcoin holder give them to you, for example in exchange for a good or service, or go through an exchange platform that converts conventional currencies into bitcoins , or have earned them by participating in currency control operations .

The Bitcoin source codes have been released under an MIT open source license which permits the use, copying, modification, merger, publication, distribution, sublicense and/or sale of copies of the software, provided that a notice of copyright in all copies.

Bitcoin at the service of human rights and individual freedoms

Transcript of a video made by Alex Gladstein, strategy director of the non-profit organization Human Rights Foundation (HRF). Text translated by Sébastien Gouspillou, CEO of BigBlock DataCenter .

Bitcoin has won over some of America’s best-known billionaires, and institutions around the world consider it a serious financial asset. But the rising price of bitcoin is only part of the story. Whether they know it or not, people who buy bitcoin are reinforcing a human rights protection tool. This still relatively new form of e-money is resistant to censorship, seizure, borderless, permissionless, pseudonymous, programmable and peer-to-peer.

With bitcoin, transactions do not go through banks or financial intermediaries, they go directly from one person to another. Payment processing is not performed by a regulated company such as Visa or Mastercard, but by a decentralized global software network. The storage is not managed by a bank but by the users themselves. The issuance of Bitcoin is not determined by central bankers. The currency’s creator, Satoshi Nakamoto, set it at an ultimate limit of 21 million. No one can print anymore. Bitcoin transactions cannot be stopped and you do not have to provide your name, address or phone number to participate. You just need internet access.

In 2017, economist Paul Krugman described bitcoin as “a sophisticated technology that no one really understands. There is no evidence yet that it is actually useful in conducting economic transactions. There is no anchor for its value. »

Krugman lives in a protected environment, within a liberal democracy with its constitutional checks and balances. Its currency is globally dominant and relatively stable. It’s easy for him to open a bank account, use a mobile app to pay bills, or grow his wealth by investing in real estate or stocks. But not everyone has this level of privilege. About 4.2 billion people live under the rule of authoritarian regimes, regimes that use money as a tool for surveillance and state control. Their currency is often degraded and they are, for the most part, cut off from this international system which benefits Krugman. For them, saving and transacting outside the jurisdiction of the government is no sleazy business.

In China, if you type or say the wrong word, the Communist Party can suspend your financial services. This devastating consequence creates a chilling effect for dissidents and creatives, who are forced to use the country’s increasingly centralized digital economy. In Hong Kong or Russia, donors to human rights organizations can have their bank accounts suspended and funds seized. Over the past few months in Belarus and Nigeria, nationwide protests have erupted against tyranny and corruption. In both places, activists raising funds to support the democracy movement have had their bank accounts frozen. Just a few days ago, during the latest coup in Burma, the military shut down the banking system and ATMs.

For activists under state repression, bitcoin is a way to protect their assets in cyberspace, locked away by encryption, safe from devaluation, in a network that has never been hacked. For them, it’s digital silver and gold together.

And in Cuba, Nigeria, China, Pakistan, Venezuela, Russia, Turkey, Argentina, Palestine, Palestine, Zimbabwe and elsewhere, bitcoin is spreading and helping people escape tyranny and to the collapse of the currency. In recent months, activists in Belarus have used bitcoin to challenge the regime by sending the equivalent of $3 million of the elusive money directly to strikers, who then convert it locally into rubles in peer-to-peer markets, to feed their families as they protest against the country’s dictatorship. In October,

In Russia, political opponent Alexei Navalny has raised millions of bitcoins despite Vladimir Putin’s tight control of the traditional financial system. Putin can do a lot of things, but he can’t freeze a bitcoin account. In Iran, Palestine and Cuba, populations are subject to sanctions and other embargoes aimed at antagonizing their corrupt leaders. Bitcoin gives them a lifeline by allowing them to earn income or receive funds from abroad. Some Venezuelans, after watching their country’s currency evaporate due to hyperinflation, are converting their resources into bitcoin digital tokens and then escaping. With their savings secured by a password, stored on a USB drive, phone or even memorized, they can start a new life in other countries,

Citizens of democracies also face financial controls, a state of burnout, and an ever-expanding state of surveillance. But those fortunate enough to live in open societies can vote, sue, protest and write, and it can help protect their financial freedom and privacy. The billions of people who live under the yoke of authoritarian governments do not have the same options.

Unlike democracy, bitcoin is universally available. You don’t need a passport, bank card or voter registration card to use it. No government can deactivate your bitcoin if it is threatened by your ideas. We are at the heart of a great digital transformation, at a time when cash, one of the last bastions of privacy and freedom, is disappearing. People increasingly rely on easy-to-monitor apps like Apple Pay and AliPay — and, perhaps soon, central bank-issued digital currencies as their primary means of exchange. Bitcoin offers an alternative to our increasingly centralized financial system. It gives any activist or journalist a way to fundraise without censorship,

Bitcoin was not as powerful five years ago, before it had global liquidity. But today, exchanges everywhere have sprung up, daily trading volume exceeds that of Apple or others, and peer-to-peer marketplaces such as Paxful and Local Bitcoins have expanded, allowing users to exchange bitcoins. in local currency almost anywhere in the world.

Maybe you don’t need Bitcoin. Maybe you don’t understand bitcoin. Maybe PayPal, Venmo, or your bank account is perfect for you. But don’t limit Bitcoin to just a vehicle for financial speculation. For millions of people around the world, it is an escape hatch against tyranny – nothing less than the currency of freedom.

Who decides on Bitcoin improvements?

Bitcoin is a free protocol and Bitcoin Core, the reference implementation of the Bitcoin protocol, is open source software.

The Bitcoin Core R&D lab is a Github repository administered by a lead developer (currently Wladimir J. Van Der Laan) who can merge the various proposals into the main code.

However, his role does not constitute a point of vulnerability because if this Github repository falls into the wrong hands or if this main developer merges lines of code that have not been approved by the consensus of other renowned developers in the community, it will be disavowed and anyone can propose another deposit. Similarly, anyone can contribute, even anonymously, to improving the code.

Moreover, developer consensus is not enough. As renowned as they are, the developers working around the Bitcoin protocol have no decision-making power, they are only a force of proposal. When a new version is proposed (usually after long discussions, numerous proofreadings and numerous tests), the code is proposed to the nodes of the network which are free to adopt it or not.

Barring exceptions (and with the consensus of the community), the proposed code is always backwards compatible, which means that the transaction blocks produced by mining nodes updated with a new version are recognized as valid by the old nodes. which have not accepted the update (the reverse is not necessarily true, which encourages the nodes to update).

In the end, it is the consensus of all nodes [1] (not just mining nodes) that has the last word.

| BTC | EURO |

|---|---|

| 1 BTC | €36,750.36 |

| 5 BTC | €183,751.82 |

| 10 BTC | €367,503.65 |

| 25 BTC | €918,759.13 |

| 50 BTC | €1,837,518.25 |

| 100 BTC | €3,675,036.50 |

| 200 BTC | €7,350,073.00 |

| 500 BTC | 18,375,182.50€ |

| 1,000 BTC | 36,750,365.00€ |

| 2,000 BTC | €73,500,730.00 |

| 5,000 BTC | €183,751,825.00 |

| 10,000 BTC | 367,503,650.00€ |

| EURO | BTC |

|---|---|

| 1€ | 0.00002721 BTC |

| 5€ | 0.00013607 BTC |

| 10€ | 0.00027214 BTC |

| 25€ | 0.00068036 BTC |

| 50€ | 0.00136071 BTC |

| 100€ | 0.00272143 BTC |

| 200€ | 0.00544286 BTC |

| 500€ | 0.01360714 BTC |

| €1,000 | 0.02721429 BTC |

| €2,000 | 0.05442857 BTC |

| €5,000 | 0.13607144 BTC |

| €10,000 | 0.27214287 BTC |

| SATOSHI | EURO |

|---|---|

| 1 sats | €0.00 |

| 5 sats | €0.00 |

| 10 sats | €0.00 |

| 25 sats | €0.01 |

| 50 sats | €0.02 |

| 100 sats | €0.04 |

| 200 sats | €0.07 |

| 500 sats | €0.18 |

| 1,000 sats | €0.37 |

| 2,000 sats | €0.74 |

| 5,000 sats | €1.84 |

| 10,000 sats | €3.68 |

| EURO | SATOSHI |

|---|---|

| 1€ | 2,721 sats |

| 5€ | 13,607 sats |

| 10€ | 27,214 sats |

| 25€ | 68,036 sats |

| 50€ | 136,071 sats |

| 100€ | 272,143 sats |

| 200€ | 544,286 sats |

| 500€ | 1,360,714 sats |

| €1,000 | 2,721,429 sats |

| €2,000 | 5,442,857 sats |

| €5,000 | 13,607,144 sats |

| €10,000 | 27,214,287 sats |

| MBTC | EURO |

|---|---|

| 1mBTC | €36.75 |

| 10mBTC | €367.50 |

| 100mBTC | €3,675.04 |

| 1,000mBTC | €36,750.36 |

| EURO | MBTC |

|---|---|

| 1€ | 0.02721mBTC |

| 10€ | 0.27214mBTC |

| 100€ | 2.72143mBTC |

| €1,000 | 27.21429mBTC |

| BITS | EURO |

|---|---|

| 1 bits | €0.04 |

| 10 bits | €0.37 |

| 100 bits | €3.68 |

| 1,000 bits | €36.75 |

| EURO | BITS |

|---|---|

| 1€ | 27.21 bits |

| 10€ | 272.14 bits |

| 100€ | 2,721.43 bits |

| €1,000 | 27,214.29 bits |

Bitcoin(BTC) is the name and largest unit of the mother of all cryptocurrencies. A bitcoin has 8 decimal places. The eighth decimal place, the satoshi, represents the smallest BTC unit of account. One bitcoin consists of 100 million satoshi.

Bitcoin euro rate

The price of Bitcoin is formed by supply and demand, analogous to pricing on a stock exchange. Pricing takes place on so-called crypto exchanges.

For this reason, there is no “official” Bitcoin price in euros or US dollars, as it can differ from crypto exchange to crypto exchange.

Traditional currencies such as euros, dollars or yen are called fiat money. Crypto exchanges work in a similar way to the forex market. In principle, different cryptocurrencies can be exchanged for each other on these, which decisively determines the pricing. Because these unregulated exchanges are not affiliated with each other, exchange rates may vary. The price at which you can buy or sell your BTC depends on the current price of the crypto exchange you are on.

The price of Bitcoin is subject to constant – sometimes strong – fluctuations. These fluctuations (or volatility) are amplified by the fact that the total volume of Bitcoin is significantly smaller compared to similar commodities (e.g. gold).

Bitcoin units

A special feature of Bitcoin is the limitation of its sum of money. In total, it is 21 million. One consequence of the currently very high BTC price is that even the smallest fragments of a bitcoin are worth a lot, which can make the conversion into fiat money seem complicated.

Because of this, there are a number of smaller subunits, each with its own name. The largest unit is logically Bitcoin.

- 1 bitcoin consists of 1,000 mBTC (milli-bitcoin). This in turn is divided

- 1mBTC in 1,000 bits. The smallest unit then are the satoshi.

- 1 bit equals 100 satoshis. In our tables you can easily find out how these sub-units currently relate to the euro.

Bitcoin and the Super Cycle Possibility

The Bitcoin fans are beside themselves. It took three years for Bitcoin to reach the $20,000 mark again. The digital cryptocurrency saw its last massive surge in 2017, when it rallied from $1,000 at the start of the year to $19,655. At first glance, many things seem similar. Because the Bitcoin price also rose rapidly in 2020, but this time a lot is different:

- the event of the century COVID keeps the world in suspense

- Bitcoin is now referred to as the Gold 2.0, the digital version of gold as a store of value

- Institutional investors jumped in after the crash in 2018 and bought the blockchain-based currency

- Bitcoin is now much more user-friendly than it was three years ago

Bitcoin super cycle

But something else could also happen: The cryptocurrency could also elude the classic mental models of a bull/bear cycle, break all conventions and experience a massive price increase through a “super cycle”. Dan Held, who works for the crypto exchange Kraken, already formulated this concept in a tweetstorm.

Bitcoin’s market cycle is typically around four years, and some experts hypothesize that the super-cycle could be triggered by the “halvings” encoded in the blockchain code, the pre-programmed halving of the new supply of Bitcoin.

Bitcoin inventor Satoshi Nakamoto came up with the idea that reducing the supply of digital coins through halving over time while demand increases creates greater value. An explanatory model for Bitcoin’s viral market loops, which is recognized among experts, is the phased scarcity. Specifically, Satoshi Nakamoto explains in the Bitcoin white paper :

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as the number of users increases, so does the value, which could attract more users to take advantage of the increasing value.”

Satoshi is addressing the network effects and postulated them at a time when Bitcoin was worth 50 cents. In the chart below we have the bitcoin price and the halvings which are the dashed lines. It can be clearly seen that there has been a bull run after each halving:

What is different from 2017?

What is special this time is that Bitcoin has strong fundamentals and that there are additional substantive reasons for the price increase: Bitcoin is now needed to hedge against impending inflation. This narrative makes 2020 unique for the largest cryptocurrency.

Bitcoin was launched during the 2008 financial crisis and is a counter-model to the financial and banking system, which Nakamoto believes was ailing at the time. The global economy has grown steadily since then, and there have been no notable recessions in the traditional financial markets since 2008. Corona changed this: A veritable health crisis developed as a fire accelerator for a monstrous economic crisis, the most severe recession since the world wars, far more dramatically than in 2008.

And this is the first litmus test for Bitcoin. Will all the bitcoin disciples and crypto fans lose their nerve and sell? Will Bitcoin price plummet as global economy tumbles? Isn’t bitcoin a “safe haven” in times of crisis and can’t it compete against gold and real estate as a valuable asset class?

At first, everything pointed to it: Bitcoin, along with the stock markets, crashed dramatically on March 13, 2020, Black Friday, to $4,121. But the much-criticized cryptocurrency has had a resurrection and emerged from this crisis stronger, as we are trading at $28,000 today .

Inflation of fiat currencies

As Bitcoin rallied, governments outdid each other with bailouts funded by printing money. And this starting of the money printing presses is unprecedented in financial history: never before has the money supply been increased so massively in such a short time. But central banks are also moving with the times: They do not print money, but buy bonds from financial institutions and banks and transfer fresh fiat money that has arisen from nothing. Commercial banks circulate the fresh funds in the form of loans.

This means that governments are currently actively devaluing their currency. And this is precisely the scenario against which Bitcoin is one of the remedies: an inflation-proof currency that is not controlled by a state, whose money supply cannot be expanded at will. On the contrary, as a result of the halving, a smaller amount, more precisely only half, of bitcoins is gradually issued until all 21 million bitcoins have been distributed among the people.

Bitcoin as a store of value

Bitcoin was created as a store of value in a world where you cannot trust your government or bank. Such moments do not come often in life, world financial crises are rare, but the current financial crisis is a key event that could help Bitcoin to go into a super cycle and thereby to a dramatic increase in value.

In addition to the Corona crisis, there is another aspect: in contrast to 2017, institutional investors are adding this new digital asset class to their portfolios and are buying Bitcoin in large quantities. While it was mainly small investors and computer freaks who were responsible for the bull run in 2017, FOMO, the “Fear Of Missing Out”, is now being felt by large investors: When COVID brought unrest to the markets, financial service providers started looking , pension funds and asset managers by safe asset classes. Bitcoin lent itself as a store of value as it outperformed gold, with plenty of imagination, buoyed by the tailwinds of digitalization, and high upside potential.

Who are the most important banks and financial service providers that stocked up on Bitcoins, the “digital gold” in the last three months:

- JP Morgan

- fidelity

- Bloomberg

- Deutsche Bank

- citibank

- Blackrock

- PayPal

Bitcoin shrugged off competitors

When Bitcoin faced many serious competitors during the 2017 bull market, there are now no opponents in the field. We remember the ICOs from 2016 to 2018, initial coin offerings with which blockchain startups tried to raise money and similar applications like Bitcoin and Ethereum, the second largest cryptocurrency. This was realized by issuing coins and tokens that were in direct competition with Bitcoin. What followed was a bloodbath: almost all ICOs failed, the cryptocurrencies, often also called shitcoins, lost their value, only a few blockchain startups survived.

Annoying forks don’t matter anymore

Another opponent was the Bitcoin family itself. Because the once sworn Bitcoin community of the years 2013 – 2015 was joined by the desire for further technical development of Bitcoin, plus the greed of some of those involved and the high criminal energy of a get-rich-fast mania . Therefore, the Bitcoin blockchain, loosely translated chain of data blocks, was often divided and split off in violent trench warfare, one speaks of “forks”, and Bitcoin offshoots were created. The most important bitcoin fork and competitor was bitcoin cash, which saw itself as a means of payment that could have been used to pay small amounts quickly at the checkout. But the bitcoin cash narrative is not catching on. Another important fork was Litecoin, which forked back in 2011. However, Litecoin did not make the breakthrough either, The reason is that Litecoin founder Charlie Lee sold all his Litecoins at the last all-time high in December 2017 and left the project. The background to the exit has not yet been fully clarified. Other Bitcoin competitors include Bitcoin SV (Satoshi Version), Bitcoin Gold, Bitcoin Diamond, Bitcoin Zeo, Bitcoin Private, Super Bitcoin, all of which are irrelevant today.

Bitcoin unchallenged at the top

In 2020, Bitcoin clearly led the cryptocurrencies, the narrative of digital “Gold 2.0” gives the coin a decisive unique selling point.

In the early years of bitcoin, it was difficult for many people to buy bitcoin and keep it safe. Often you first had to make a transfer in advance and then trust that the cryptocurrency exchange actually bought the bitcoins for you. Today, crypto exchanges are controlled by state supervisory authorities, in Austria by the Financial Market Authority. Numerous cryptocurrency exchanges with excellent user experience and impeccable services are now available to buyers. PayPal also offer Bitcoin as a means of payment, and the Stuttgart Stock Exchange operates its own Bison app, which can be used to buy Bitcoin.

Is the super cycle coming?

Whether and when there will be a Bitcoin super cycle cannot be predicted. However, compared to currencies, bonds, stocks and gold, a super cycle is more likely. Because one should ask what happens when part of the world’s assets under management flows into Bitcoin. World financial wealth is estimated at around 100 trillion euros. Even if only 0.01% of this is invested in Bitcoin, this could lead to an almost unbelievable price increase to unprecedented heights.

Here we are no longer talking about a $20,000 to $100,000 surge resulting from the widely used Fibonacci charting technique. In a super cycle, mathematical price jumps of more than a million euros for a Bitcoin are conceivable due to the network effects, the fixed Bitcoin money supply and the increasing sluggishness of gold. Purely hypothetical. In the super cycle lies the fantasy of bitcoin, which other asset classes mostly lack. This is what makes Bitcoin unique.

Tutorial: installing a bitcoin wallet

At the request of several readers, here is a tutorial for beginners who wish to install a Bitcoin wallet in order to try their hand at peer-to-peer transactions.

For this tutorial, I chose the Copay wallet, an open source and multi-signature “Bitcoin wallet” produced by BitPay , because it seems particularly simple to me, it is multilingual and it is available on all systems . Other choices are obviously possible and relevant.

1. Download, install and launch the app that matches your device/operating system: Android , iOS ( iPhone and iPad ) , Windows Phone , Windows , Linux , OS X or Google Chrome .

2. The second thing to do is to create a wallet recovery phrase that will allow you to find your bitcoins even if your device is lost or destroyed (phone, tablet, hard drive, etc.). Click on the settings icon (cogwheel) and then on the “Save” tab . Warning: this recovery phrase does not protect you from theft or viruses that could infect your device.

3. Carefully write down all the generated words respecting the order. Save this recovery phrase. You can multiply the supports but make sure that no copy falls into the wrong hands. Click on ” continue”, select the words in the order of the copied list and click on ” continue”.

4. Click on the “menu” icon then on “SETTINGS / Global preferences”.

5. Choose the unit. One bit (or microbitcoin ) = 0.000001 bitcoin. For my part, I prefer a display in bitcoins ( BTC ).

6. Choose the local currency that speaks to you the most.

7. Click on “Close ” to return to the welcome screen. Click on “RECEIVE” to receive bitcoins.

8. Copay automatically generates a receiving bitcoin address. You can copy it to send it to your debtor (in this example the address to copy is 1HL1CgpRJoXJaFkRGzqa4q1uYcn3yTydUr ). If he is in front of you and has a wallet installed on a smartphone or tablet, he can also flash the generated QR code . This QR code will allow him to instantly copy your public address in order to send you bitcoins. Note that with this address your interlocutor will not be able to take bitcoins from you). Please note that the transaction is recorded after a few seconds, but you will have to wait ten minutes on average for it to be validated by the network and for you to be able to spend the funds received.

9. Now that you have bitcoins, you can pass them on. Click on “SEND” and enter the external Bitcoin address you want to credit (often the one that the merchant will have generated for you). If your device has a camera (smartphone, tablet, etc.), you can also click on the round icon to flash the QR code you have been given. Enter the amount and click “SEND” .

What you need to know

To experience Bitcoin, it is necessary to take certain precautions. Bitcoin allows money and value to be exchanged, so it is essential to secure your Bitcoin wallet as you naturally do for a physical wallet that holds cash.

Backing up your wallet

Bitcoin services and software allow you to back up your wallet or private keys. Which can be printed on paper or saved on a USB key. Stored in a secure place, a backup can protect you against computer failures or various human errors.

Encrypt your wallet

Encrypting your wallet allows you to enforce a password against anyone attempting to withdraw funds. Which can protect you from theft and hacking. But not against keyloggers. You must ensure that you never forget your password otherwise your money will be lost. Unlike your bank, you cannot recover your password with Bitcoin!

Be careful with online wallets

Using an online wallet is a bit like using an online bank. You trust a company to store your money while all you have to do is remember your password and keep it safe. You should choose this kind of service with caution. To date, none of these services offer enough assurance and security to store value like a bank.

Using offline backup for savings

Using an offline wallet offers the highest level of security for savings. It involves storing a wallet only on paper and on USB keys in different secure places that are not connected to any network. This is good protection against computer failures and vulnerabilities, theft and human error. To date, this approach still requires technical knowledge to be performed correctly.

The value of bitcoin is volatile

The value of bitcoin can rise or fall unpredictably over a short period of time due to its young economy, unusual nature and sometimes illiquid markets. As a result, keeping a large portion of your savings with Bitcoin is not recommended. Bitcoin should be considered a high-risk asset and you should only ever store money with Bitcoin that you can afford to lose. If you receive payments in bitcoins, many service providers allow you to transfer your bitcoins instantly into your currency.

Bitcoin payments are irreversible

Any transaction made with Bitcoin cannot be reversed. They can only be reimbursed by the person receiving the funds. Which means you need to make sure you’re trading with companies and people you know and can trust. But don’t worry, Bitcoin can detect typing errors and usually won’t let you send money to an invalid address.

Bitcoin is not effortlessly anonymous

All Bitcoin transactions are publicly and permanently stored on the network. Which means anyone can view the balance and transactions of each Bitcoin address. Although it is very difficult to associate a Bitcoin address with its owner, it is still recommended to use a new address each time you receive a payment. This practice is especially important for public uses such as websites.

Bitcoin is still experimental

Bitcoin is an experimental new currency that is under active development. Although it becomes less and less experimental every day as its use increases, you must keep in mind that Bitcoin is a new invention that plays on a ground that has never been explored to date. As a result, his future cannot be predicted by anyone.

Don’t forget to pay your taxes

Bitcoin is not an official currency. That being said, most jurisdictions still require you to pay taxes on income, sales, wages and wealth. It is your responsibility to inform yourself and comply with applicable laws.

SPEND BITCOINS

Do you want to add your activity? Contact us . You can also contribute to the enrichment of this list through this topic on bitcointalk .

Disclaimer: 1. On-chain payments for low value goods or services are not always relevant due to transaction fees. On the other hand, the Lightning Network, which allows you to spend bitcoin without registering on the blockchain, is perfectly suited to this use.

2. A payment in bitcoins is irreversible, it is up to you to assess the reliability and seriousness of these establishments before any payment.

Categories:

– Lightning Network

– Buy cryptocurrencies

– Buy euros

– Pet stores, food and accessories

– Antiques, flea markets

– Art, crafts and design

– IT assistance

– Automobile / motorcycle / scooter / bicycles

– Bars

– Building

– Jewelry, watches and accessories

– Good being, aesthetics, cosmetics, pharmacy and parapharmacy

– Capilliculture

– Gift cards / virtual payment cards

– Electronic cigarettes, smoking accessories, CBD

–Electronic circuits

– Courses and training

– Creation of websites

– Kitchen

– Decoration / furnishings

– Donations to organizations and projects

– General e-commerce

– Economy

– Environment

– Domestic equipment

– Coworking spaces

– Flowers, garden centres, plants, household items garden

– VPN provider

– Miscellaneous hardware gadgets and goods

– Web

hosting – Real estate/hotels/guesthouses/apartments

–Classic and 3D printing

– Internet, various services

– Video games, various games and toys

– Software and applications

– Computer hardware, electronics, sound and lighting

– Precious metals

– Mining (Bitcoin / Altcoins)

– Model making

– Music

– Optics

– Tools for merchants

– Classified ads

– Food

products – Cultural products – magazines

– Digital products

– Restaurants

– Dating sites

–Computer security and maintenance

– Miscellaneous

services – Legal and accounting services

– Care and health

– Sports and leisure

– Telephony

– Clothing, shoes and accessories

– Wines and spirits

– Travel

Bitcoin transaction

Bitcoin transactions are secured by digital signatures and are sent back and forth between Bitcoin wallets. Every user in the Bitcoin network can view every transaction that has ever been made via the Bitcoin blockchain.

There are no bitcoins, only records of bitcoin transactions

First the confusing part: bitcoins don’t exist anywhere, not even on a hard drive. It is said that someone owns bitcoins , but if you search for a specific bitcoin address , you won’t find any digital bitcoins there . You can’t refer to a physical object, not even a digital file, and say: this is a bitcoin .

Instead, there are only records of transactions between different addresses with balances that have either increased or decreased. Every transaction that has ever been carried out is stored in a public register (ledger) called the blockchain . If you want to calculate the balance of any Bitcoin address , you have to calculate it using the blockchain , because no information is stored in the address .

What does a bitcoin transaction look like?

If Alice sends Bob some bitcoins , then this transaction contains three pieces of information:

- One input: this is a record of which sender address previously sent Alice these bitcoins (she received them from her friend Eve).

- A lot: this is the (sub)set of bitcoins that Alice sends to Bob.

- One output: this is Bob’s bitcoin address (recipient address).

How is bitcoin sent?

To send bitcoins , you need two things : a bitcoin address and a private key. A bitcoin address is randomly generated and consists of a sequence of letters and numbers. The private key is a different sequence of letters and numbers, but unlike the Bitcoin address , it is kept secret.

The Bitcoin address can be imagined as a locker with a glass door. Everyone knows what’s in it, but only the private key can open the locker and put things in or out.

When Alice wants to send bitcoins to Bob, she uses her private key to sign a message with the input (the coins’ previous transaction ), the quantity, and the output (Bob’s address ).

Then she sends her bitcoins from her wallet to the bitcoin network. There , bitcoin miners verify the transaction , place it in the transaction block, and eventually resolve it.

Why do you sometimes have to wait for a transaction to be confirmed?

Because a transaction needs to be confirmed by miners, sometimes you’re forced to wait until they’re done mining. The Bitcoin protocol is set in such a way that each block takes about ten minutes to be mined.Some merchants make the user wait for the block to be confirmed. On the other hand, there are some traders who don’t wait for the transaction to be confirmed. They take the risk and assume that you don’t try to spend your bitcoins on other things before the transaction is confirmed.

This is common for low-end transactions (micropayments) where the risk of fraud is not as high. Each recipient can decide for themselves how many confirmations they want. The principle applies that more confirmations make the transaction more secure, but also slow it down.

What happens if the input and output quantities are not equal?

Because bitcoins only exist as records of transactions, many different transactions can be tied to a specific bitcoin address . Perhaps Jane sent Alice two bitcoins , Philip sent her one bitcoin , and Eve only one—all as separate transactions at separate times. They are not automatically converted into six existing bitcoins in one file in Alice’s wallet, they simply exist as different transaction records. When Alice wants to send bitcoins to Bob, her wallet will try to use transaction records with different amounts that add up to the amount of bitcoinsadd up the ones she wanted to send to Bob.

There is a chance that Alice’s wallet does not have the exact amount of summable transaction records that she wants to send to Bob. If Alice wants to send about 1.5 BTC to Bob and none of the transactions she has in her wallet corresponds to this amount or can be added to this amount, then the following happens: Alice sends the two bitcoins she received from Jane, to Bob. Jane is the input and Bob is the output. However, since Alice wants to send the amount of 1.5 BTC, her wallet automatically creates two outputs for her transaction : 1.5 BTC to Bob and 0.5 BTC to a new address created to receive Bob’s change for Alice to keep.

Are there transaction fees?

Transaction fees are calculated based on various factors. Some wallets allow you to set transaction fees manually. The higher the fee, the faster the transaction will be processed. Any portion of a transaction that is not taken by the recipient or given as change is seen as a fee.This then goes as a bonus to the miner who has managed to finish calculating the transaction block. However , the transaction fees for international transfers are usually well below the usual bank transaction costs.

What if you only want to send part of a bitcoin?

Bitcoin transactions are divisible. A satoshi is one hundred millionth of bitcoin . It is possible to send a bitcoin transaction in an amount of 5,430 satoshi.

How does bitcoin work?

Bitcoin uses public and private key cryptography (asymmetric cryptography). A bitcoin balance is attached to the public key of its owner. When bitcoins are transmitted from user A to user B, A signs a transaction with his private key and broadcasts it on the network which identifies his signature and credits the address of B which in turn can the funds received.

In order to prevent A from passing funds that have already been used to a user C, a public list of all past transactions is maintained collectively by the network of Bitcoin nodes. Thus, we will check before any transaction that the bitcoins sent have not already been spent.

The basis for a new user

As a new user, you only need to choose a wallet that you will install on your computer or on your mobile. Once ready, your wallet will create your first Bitcoin address and you can create new ones whenever you need. You can share one of your Bitcoin addresses with a friend so they can pay you. Similarly, you can pay your friends if they give you their addresses. In fact, exchanging Bitcoins is quite similar to exchanging emails. Then all that remains is to get some Bitcoins and keep them safe . As a user, you do not need to know the technical operation.

blockchain

The blockchain is a shared and public transaction log on which the Bitcoin network is based. All confirmed transactions are included in the blockchain without exception. In this way, it is possible to verify that each new transaction exchanges bitcoins belonging to the issuer of the payment. The integrity and chronological order of the blockchain is protected by cryptography .

Transaction

A transaction is a transfer of value between Bitcoin addresses that is included in the blockchain. Bitcoin wallets store secret information for each Bitcoin address called a private key . Private keys are used to sign each transaction, providing mathematical proof that they came from the correct owners. The signature also helps prevent the transaction from being modified once issued. All transactions are broadcast between users and are confirmed by the network within minutes through a process called mining .

Mining

Mining is a distributed consensus system that is used to confirm pending transactions by including them in the blockchain (a confirmation means that a transaction has been verified by the network and its chances of being reversed are almost non-existent A single confirmation provides a good level of security For large payments it is strongly recommended to wait until a transaction has accumulated more confirmations – six is the most common norm Each new confirmation decreases the risk of a reversal exponentially). Mining enforces a chronological order in the blockchain, protects network neutrality, and allows computers on the network to agree on the state of the system. To be confirmed, transactions must be included in a block (a block is an addition to the blockchain that contains and confirms several pending transactions. Approximately every 10 minutes, a block is added to the blockchain via mining )which must correspond to very strict cryptographic rules which are then verified by the network. These rules prevent the modification of an earlier block because the logic of the following blocks would be broken. And they create the equivalent of a competitive lottery that prevents any individual from adding blocks consecutively into the blockchain. This way, no individual can control what is included in the blockchain or override parts of it to undo their own transactions.

How are bitcoins created and distributed?

Bitcoin has a complete list of transactions that have been made between all users. Several transactions are put together in a block and the more time passes, the longer the blocks get. With each first transaction of a block, the computer that creates it will receive a Bitcoin to thank it for participating in the proper functioning of the system. As the block length gets bigger and bigger, it means that there will be less and less Bitcoins that will be generated.

The function thus defined is a logarithmic curve which will eventually reach around 21 million Bitcoins. This is the maximum total amount of Bitcoins that will eventually be available on this system. The generation of new bitcoins can be schematized as follows: 50 bitcoins are generated every 10 minutes during the first 4 years, then this value increases to 25 BTC every 10 minutes during the following 4 years (from November 2012), and continues to be halved approximately every 4 years (actually every 210,000 blocks of transactions) until reaching the maximum number around 2140.

Where are my bitcoins stored?

A bitcoin is nothing tangible, it’s just an entry in a ledger of which there are thousands of copies (and no originals).

Bitcoins are not stored in a specific location, but on all nodes of the network at the same time, in the blockchain (the large register of transactions). So you can receive bitcoins even if your software wallet is off, or even if you don’t have any wallet, just a couple of cryptographic keys written down on a piece of paper. Software is only needed when you want to spend your bitcoins.

The question is therefore not to know where your bitcoins are, but where the secret of your private key is hidden!

Course and milestones of the oldest cryptocurrency in history

Bitcoin is the oldest and also the most expensive cryptocurrency in the world. Since its inception in 2008, the cryptocurrency has experienced a rapid increase in value. A current overview of relevant stations.

In 2008, the idea of a digital cryptocurrency took off for the first time. Unknowns under the Japanese name “Satoshi Nakamoto” published a white paper that contained the idea of a decentralized currency that would not be controlled by states or banks. Programmers then came across this vision, which was realized in 2009 in the form of what is now the oldest cryptocurrency, Bitcoin. In January 2009, the first bitcoin block was created.

A trading place where Bitcoin could be traded opened. The value of today’s most important cryptocurrency was determined by the mining costs – due to the low demand there was no official exchange rate at the time. Bitcoin was worth 0.08 cents in 2010. Bitcoin was first mentioned in the media in February 2011. The price then climbed to one US dollar. Since then, Bitcoin has caused a sensation. It was not until November 9, 2021 that the oldest cryptocurrency reached a new all-time high before the price fell again to around $32,500 in February 2022. Bitcoin’s current all-time high on November 10, 2022 is $ 68,789.63 per coin.

Below are the most important events and the price development of the cryptocurrency Bitcoin – starting with the current status.

How expensive was the first bitcoin? The Bitcoin in the course history

March 31, 2022 – EU votes to regulate unhosted wallets

As the news platform “BTC-Echo” reports, the EU Parliament is voting on the so-called “Transfer of Funds Regulation”. The decision can have serious consequences for the entire crypto sector in the European Union: Among other things, the TFR prescribes strict anti-money laundering measures for the transaction of crypto values for crypto service providers in the future. These would apply to transactions from or to so-called unhosted wallets. Unhosted wallets are addresses that are the responsibility of the respective user apart from crypto exchanges. As a result, providers will have to introduce complex acquisition and verification procedures for transaction data in the future. In addition, the stock exchanges must share this data with the responsible authorities from a volume of 1,000 euros.

In addition, paragraph 18aa can be found in the group of topics “G”. According to this, providers of crypto transactions may in future not allow “any transfers of crypto values” from or to non-compliant providers of crypto transfers. Industry experts see this as a de facto ban on such unhosted wallets. The Bitcoin price subsequently falls to around $44,500.

March 23, 2022 – Thailand bans the use of cryptocurrencies as a means of payment

Thailand bans cryptocurrencies like Bitcoin as a means of payment. The new regulation is scheduled to come into force on April 1, 2022, but will not affect trading or investments in digital assets. Entrepreneurs, including crypto exchange operators, will no longer be allowed to offer crypto payment services. This is reported by the responsible regulatory authority.

The ban on Bitcoin and Co. as a means of payment in Thailand comes as no surprise. Regulators had already announced this decision in January.

March 17, 2022 – Fed raises US interest rates, Bitcoin surges above $40,000

Bitcoin is trading above the $40,000 mark again. The previous evening, the Fed announced that US interest rates would be raised by 25 basis points to between 0.25 and 0.5 percentage points. This hike by the central bank was already expected and priced in accordingly. Many market participants had expected the Fed to act more aggressively and raise interest rates more sharply.

February 9, 2022 – Russia wants to effectively recognize cryptocurrencies as a currency

Apparently, Russia no longer wants to ban cryptocurrencies such as Bitcoin or Ethereum, as the central bank had demanded a few weeks ago. On the contrary: cryptocurrencies should be legalized in Russia and recognized in the same way as currencies.

This emerges from a report published by the Russian government, and the business newspaper Kommersant also reports on it.

11 years ago, the Bitcoin price crossed the 1 dollar mark for the first time

February 9, 2011 is one of the milestones in the development of the Bitcoin course to date. On this date, the value of a bitcoin exceeded the 1 dollar mark for the first time after the then still very young and almost unknown cryptocurrency was first mentioned in the media.

February 7, 2022 – Bafin warns against crypto investment tips on social media

The financial regulator Bafin warns private investors of the risks of investing in crypto assets and investment tips on social media. Enthusiastic reports about Bitcoin, Ether and Co. were circulating there, but investments in crypto assets are highly speculative and just as risky, the regulator warns. In the worst case, there could be a total loss of the money invested.

The International Monetary Fund (IMF) is calling on El Salvador to abandon bitcoin as legal tender. El Salvador was the first country in the world to give cryptocurrency this status in September last year.

In a statement, the IMF Board emphasized that there are great risks associated with the use of Bitcoin. These included, for example, risks to financial stability, financial integrity and consumer protection as well as the associated tax contingencies.

January 3, 2022 – First Bitcoin block is created 13 years ago

3 years ago, inventor Satoshi Nakamoto mined the first bitcoin block. The term Bitcoin Mining describes the process in which the computing power for transaction processing, security and synchronization of all users in the network is made available. The first bitcoin block created – and thus the start of the bitcoin blockchain – is also referred to in the community as the “Genesis Block”.

December 31, 2021 – Bitcoin records significant gains over the year

Despite some severe corrections, Bitcoin ended 2021 with a price gain of more than 62 percent compared to the 2020 closing price.

The oldest cryptocurrency ended 2020 at a price of 29,001.72, according to the analysis house Coinmarketcap. This compares to $47,178.13 on December 31, 2021.

November 24, 2021 – Greenfield One launches Europe’s largest crypto fund

The Berlin financial investor Greenfield One has launched the largest European crypto fund to date. A total of 135 million euros were collected – among others from Bertelsmann Investments, Swisscom and CommerzVentures, Greenfield One said. The fund thus surpasses the crypto money pots of the current frontrunners in Europe, Fabric Ventures and Rockaway.

November 21, 2021 – El Salvador plans global pilot “Bitcoin City”

El Salvador wants to push the use of bitcoin further with a new city whose construction financing is said to be based on the cryptocurrency. According to President Nayib Bukele, “Bitcoin Cty” should become the first city of its kind in the world to be built with the proceeds from new Bitcoin bonds. It should be built in the eastern region of La Union, use geothermal energy from a volcano and levy no taxes other than VAT.

November 14, 2021 – Bitcoin update “Taproot” released

After three years of development, the Bitcoin update dubbed Taproot has been released. The update includes many small rule changes that have now been added to the network. These are intended to make Bitcoin faster, more efficient and more anonymous. Taproot was implemented in the form of a so-called soft fork – the old rules remain in place and new functions are added. This enables the blockchain to use both the old and the new set of rules.

November 9, 2021 – Bitcoin hits new all-time high

Bitcoin hits a new record high with a price of $68,530.43 . Bitcoin has never been so expensive. Since the annual low in July, Bitcoin has risen by around 130 percent – the market value is almost 1.3 trillion dollars.

October 31, 2021 – Bitcoin white paper turns 13

On October 31, 2008, the inventor of Bitcoin, known only under the pseudonym “Satoshi Nakamoto”, published the digital currency’s white paper. The working paper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlines the high-level engineering behind what is now the world’s largest and most important cryptocurrency.

October 18, 2021 – Bitcoin futures ETF receives approval

Wall Street is gearing up for the approval of the first bitcoin futures ETF. The exchange-traded fund from the provider ProShares will start on Tuesday under the ticker Bito, as CEO Michael Sapir confirmed on Monday.

The last rise in the Bitcoin price is due to this approval by the US Securities and Exchange Commission. Bitcoin could then break its record high of $64,863.

However, experts warn that with the launch of the ETF, some large investors will also sell their coins. This could cause the price to collapse in the short term.

September 24, 2021 – China bans cryptocurrencies

China declares all crypto transactions illegal and wants to crack down on cyber currencies. The Chinese central bank has thus sent the clearest signal to date that it intends to resolutely regulate the crypto industry.

Bitcoin price falls from $45,000 to just under $43,000. Ether, the second largest digital currency after Bitcoin, was hit harder, falling by around seven percent to just under $2,900.

September 7, 2021 – El Salvador introduces Bitcoin as its national currency

El Salvador is the first country to introduce Bitcoin as its national currency. But on the day the cryptocurrency was launched, technical problems arose. The digital wallet Chivo intended for transactions did not work, admits President Nayip Bukele. In the capital San Salvador, many people also show little interest in the innovation. As a result, Bitcoin temporarily fell by more than 15 percent to $43,285.

June 28, 2021 – Coinbase becomes the first company to be granted permission to host cybercurrency

Financial regulator Bafin gives Coinbase permission to hold cybercurrencies, sending the stock up more than 7 percent. Now users on Coinbase can buy and sell regulated digital currencies such as Bitcoin, Ethereum or Dogecoin.

June 22, 2021 – Bitcoin price slips below $30,000

According to data from the analysis house Coinmarketcap, Bitcoin fell again and slipped below the $30,000 mark with a further minus of nine percent. There are many stop-loss levels here that could accelerate a downtrend now.

June 14, 2021 – Tesla apparently wants to allow Bitcoin as a means of payment again

The electric car manufacturer Tesla will again accept the digital currency Bitcoin as a means of payment under certain conditions. This was announced by Tesla boss Elon Musk in a tweet on June 13, 2021. Bitcoin transactions should therefore be allowed again if 50 percent renewable energies are used to produce bitcoins and there is a positive trend in this regard. Following the Tesla CEO’s message, the oldest cryptocurrency surged about 12 percent to $39,535.

June 7, 2021 – Anonymous criticizes Tesla CEO Elon Musk for social media comments

A video published on YouTube, which probably comes from the group “Anonymous”, criticizes Tesla boss Elon Musk. The reason for the criticism is, among other things, social media comments by the Tesla boss on Bitcoin and other cryptocurrencies.

The anonymous spokesperson in the video, which was shared via Twitter account @YourAnonCentral among others, criticized that “the games you played with the crypto markets destroyed lives.” It goes on to say, “Millions of retail investors truly relied on their crypto profits to improve their lives (…) Your tweets this week show a clear disregard for the average worker.” Musk nonetheless continued to actively tweet about cryptocurrencies and others Topics without going into the video.

May 24, 2021 – Chinese companies stop mining cryptocurrencies

China is taking massive action against cryptocurrencies. This is now having an effect: Several companies in the industry, which earn their money with the energy-intensive so-called prospecting, also known as “mining”, of cryptocurrencies such as Bitcoin, announced that they would discontinue their business in China. The reason for this step by numerous companies is that China The State Council under Deputy Prime Minister Liu He recently announced a number of measures.

Huobi Mall, owned by cryptocurrency exchange Huobi, said it would suspend its crypto mining offering to Chinese customers. They now want to focus on business in other countries. The prospecting service providers Hashcow and BTC.TOP made similar statements.

May 14, 2021 – Musk criticizes Bitcoin and triggers a price crash

Tesla boss Elon Musk criticizes Bitcoin for its high energy consumption. He thus triggered an earthquake on the crypto markets.

With the campaign, Musk apparently wants to encourage developers to accelerate the search for more energy-efficient technologies for operating the underlying blockchain technology. And he wants to work on a solution himself. The Tesla boss then made it clear that the focus was on the fun currency Dogecoin. Musk has been promoting the digital currency for months. However, the Dogecoin recently had to record several price slumps.

The Tesla boss’s criticism of Bitcoin has unsettled investors. The digital currency rushes from $56,000 to $46,980. It was last that low for a short time in April 2021.

May 7th, 2021 – Bitcoin as a means of payment for the first time at Sotheby’s auction in New York

The auction house Sotheby’s announces an innovation for the gala auction in New York. For the first time, a physical canvas painting by Banksy entitled “Love is in the Air” can also be auctioned with digital currencies such as Bitcoin or Ether. That was different at the beginning of March.

At the Christie’s auction house, the crypto artwork, which is based on the Non Fungible Token (NTF) blockchain technology, still had to be paid for in dollars. Beeple’s artwork “Everydays: The First 5000 Days” reached a record price of $69.3 million. It was bought by Singapore-based Indian crypto entrepreneur Vignesh Sundaresan, who recently made his fortune buying and trading digital currencies.

April 14, 2021 – Crypto trading platform Coinbase goes public in the US – Bitcoin price surges above $64,000

Wall Street is gearing up for another mega IPO. The crypto exchange Coinbase goes into trading via a direct placement. Coinbase is the largest US trading platform for cryptocurrencies such as Bitcoin, Ethereum and Co. The company is one of the big winners of the ongoing crypto boom. This in turn drives the Bitcoin price. According to Coinmarketcap, Bitcoin reached a new record high of $64,365 in the afternoon German time.

February 16, 2021 – Bitcoin hits $50,000 mark

The Bitcoin course reaches another milestone. The oldest cryptocurrency broke through the $50,000 mark for the first time, rising by up to five percent to a record high of $50,602.31.

A week earlier, bitcoin traded below $38,100 only to recover subsequently. This corresponds to an increase of around 30 percent. Just two months ago, Bitcoin surpassed its 2017 record and broke through the $20,000 mark. Shortly after, the cryptocurrency cleared the $30,000 and $40,000 hurdles.

February 8, 2021 – Tesla invests $1.5 billion in Bitcoin

Elon Musk’s Tesla invests more than $1.5 billion in Bitcoin. The electric car manufacturer wants to accept the cryptocurrency as a means of payment under certain conditions in the future. Tesla bought Bitcoin to “have more flexibility to further diversify and maximize the return on our cash,” according to a report from the electric car maker to the US Securities and Exchange Commission.

January 29, 2021 – Elon Musk tweet triggers Bitcoin rally

A tweet from Tesla boss Elon Musk is enough to trigger a dynamic rally in Bitcoin and other cryptocurrencies. Musk had only deposited “#bitcoin” in his Twitter biography, supplemented by the symbol of the world’s most valuable cryptocurrency. As a result, the Bitcoin price really shot up, peaking by more than 20 percent in a 24-hour comparison to $38,406.

October 21, 2020 – Paypal wants to accept Bitcoin as a payment method

The payment provider PayPal is entering the cryptocurrency business. In the future, customers in the USA will be able to buy, sell and store Bitcoin and other cyber currencies via the PayPal platform. The news propels the cryptocurrency above $12,800 – a new yearly high.

March 16, 2020 – Corona crisis hits markets for virtual currencies

The Bitcoin price has collapsed significantly. As data from the analysis house Coinmarketcap shows, the Bitcoin price fell below the psychologically important $ 5000 mark.

Market observers did not mince words and spoke of the “crash” on the crypto market. “This sell-off has led to a cascade of exits. The vast majority of investors have chosen to hold cash,” said Wayne Trench, head of crypto brokerage OSL at Bloomberg agency.

In particular, the strong measures taken by the US Federal Reserve and the travel restrictions imposed by the US government have unsettled investors, according to many experts.

January 07, 2020 – The start of the rally – geopolitics drives bitcoin price to $8000 per coin

In early 2020, tensions in the Gulf region accelerate bitcoin, starting the rally. The oldest cryptocurrency rose 5 percent to its highest level in seven weeks at $8,000.

June 26, 2019 – Bitcoin hits $13,000 again

Bitcoin manages to rise from $5,000 to $10,000 within a short period of time. The digital currency reached its one-and-a-half-year high of $13,895 on June 26, 20219. At the same time, the discussion about the planned Facebook cryptocurrency “Libra” came up, which is why the Bitcoin price fell to $6,300 in the second half of the year.

July 24, 2018 – Bitcoin breaks the $8000 mark

Many digital currencies are increasing, according to data from the analysis company Coinmarketcap, Bitcoin is rising to over 8,000 dollars. With a plus of 6.5 percent, the price of the oldest cryptocurrency is at times $8,189, the highest it has been since May 2018.

Investors are now hoping for a further upward trend, as the past six months were still characterized by losses in value. Nevertheless, investors were able to more than triple their investment over the year.

February 6, 2018 – Bitcoin plummets over fears of regulation and is worth just $6000

Whoever buys a bitcoin for ten cents at the end of 2010 has 17,000 euros at the end of 2017. After exploding from $1,000 in January to more than $8,000 in November, the market is overheating. For fear of regulation, the oldest digital currency loses 85 percent of its peak value. About 600 other cryptocurrencies are also falling and the Bitcoin crash alone burns 500 billion euros.

December 17, 2017 – Bitcoin is worth more than $20,000; Market value at $335 billion

Bitcoin price broke through the $20,000 mark on Sunday noon, just in time for more bitcoin futures to start. In addition, trading begins on the Chicago CME, giving the world’s largest cryptocurrency a market value of $335 billion. This corresponds to an increase of 2500 percent within one year. But regulators are also alarmed. The tax authority IRS in the USA won a legal dispute and can now access user information from Coinbase.

February 28, 2014 – Bitcoin platform Mt.Gox goes bankrupt – Bitcoin price falls to $570

Mt.Gox files for bankruptcy. The former largest trading platform had debts of about 6.5 billion yen, equivalent to 46.6 million euros. Michael Karpeles, the Mt.Gox boss, indicates that bitcoins may have been stolen in a hacker attack. Reportedly, 11.4 billion yen worth of bitcoins and 2.8 billion yen worth of deposits were lost. The deposits were originally intended for the acquisition of the cryptocurrency. Even users who have opened an account with Mt.Gox have not been able to log in there since February. According to a paper published on the Internet, 740,000 bitcoins with a current value of more than $300 million could be missing. As a result, “Fox Business” published a chat log, among other things, in which Karpeles admitted that

How expensive was a bitcoin in 2013? – November 27, 2013: Bitcoin surges above $1000 for the first time

At the Mt.Gox trading venue, the Bitcoin course manages to break the $1,000 mark for the first time. The reason for this is speculators who are buying up the digital currency. The course climbed to $ 1044, which means more than 80 times growth since the beginning of the year. The increasing interest in Bitcoin from investors from China and the USA is ensuring greater acceptance of the cryptocurrency.

“Milestones tend to convey some validation, even when they’re completely arbitrary,” wrote Nicholas Colas, ConvergEx Group’s chief market strategist. “$1,000 for a bitcoin draws attention and gives pro-currency people another reason to laugh in the face of the naysayers.”

Another factor behind the increasing acceptance of bitcoin is the Cyprus crisis. Thus, a currency that exists through a software program accessible to everyone and is not regulated by any country or bank regulator can build more trust while banks can freeze their citizens’ accounts.

How expensive was a bitcoin in 2011? – One bitcoin costs one dollar in February 2011

Bitcoin was first described in the media in February 2011. On February 9, 2011, the course of the digital currency climbed to one dollar for the first time.

How expensive was a bitcoin in 2010? – July 7th, 2010: Bitcoin price rises to eight US cents per coin

Bitcoin receives a software update from a group of developers. As a result, the price increased tenfold from $0.008 to $0.08 per piece.

How expensive was a bitcoin in 2009? – In October 2009 one dollar gets 1309 bitcoin

Because of the relatively short blockchain at that time , new bitcoins can be mined quite easily. Bitcoin is priced at $1,309.03 on the New Liberty Standard crypto exchange.

How expensive was a bitcoin in 2008? – Bitcoin will become a digital reality on October 31, 2008

On a nine-page paper, one or more people using the pseudonym “Satoshi Nakamoto” describe how Bitcoin works. All of the currently existing cryptocurrencies are based on the functionality of a blockchain contained therein and the vision of a digital currency. The amount of bitcoins, which is limited to 21 million pieces, is not yet completely on the market. It is estimated that the last Bitcoin created will be calculated around 2033.

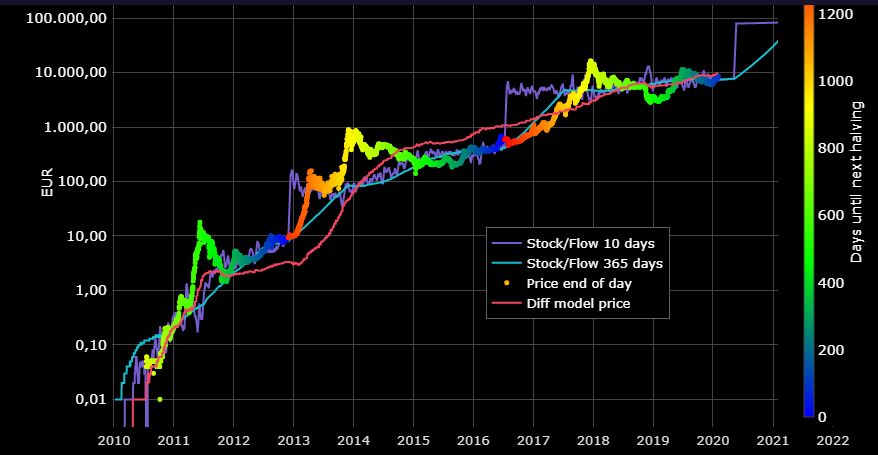

Is the “stock to flow” ratio a relevant predictive model for bitcoin?

The “stock to flow” ratio is a measure that notably makes it possible to estimate the scarcity of any precious metal by dividing the total stock already extracted available by the quantity produced annually. The higher this ratio, the less sensitive the price of the metal in question is to fluctuations in production, which is the case, for example, for gold (S/F ratio estimated at 62) and silver (S/F ratio estimated at 22), these assets are therefore considered good stores of value.

But how could this model apply to bitcoin to predict the evolution of its price? Unlike other “commodities”, the exact quantity of bitcoins is known and the upcoming rate of production can be estimated with great accuracy. Its “stock to flow” ratio is multiplied by two every 210,000 blocks, or approximately every four years, knowing that a block is created every 10 minutes on average. If we compare the evolution since 2009 of its “stock to flow” ratio and that of its value in euros, we see a statistically significant relationship… until today:

Continuing this graph, we would therefore theoretically expect a bitcoin price close to 50,000 euros before the end of 2020!… Except that this predictive model has two obvious limits:

The first is that of demand. Just because an asset becomes scarce doesn’t mean demand increases mechanically and many altcoins based on Bitcoin’s rarefaction model haven’t enjoyed the same success at all. The second is that this model will in any case not be eternally reliable since, pushing the graph a little further still, each bitcoin should be worth 1000 billion dollars in 2050 and tend towards infinity when all bitcoins will be mined. !

Like others, this predictive model therefore makes it possible above all to predict the past, but sooner or later bitcoin will end up losing it more or less gradually… the question is to know when!

Why Bitcoin will survive

How long have we been predicting the imminent demise of Bitcoin? At a dollar, it was a fad; at ten, a bubble about to burst; at one hundred, a Ponzi pyramid on the verge of collapse…

Yet after five years of existence Bitcoin is still there, it has made its way and each passing day installs it a little more on the web.

The erratic price fluctuations may be spectacular, but they do not jeopardize the project because, unlike most of its copies (one news per week on average), Bitcoin’s value is based above all on the extent of its network. : the number of users, minors and especially companies and businesses that accept it. The price fluctuates, but the network progresses safely and steadily.

Add to this that new applications of the Bitcoin network are currently under study: litigation mediation, participatory finance, intelligent property, loans with surety… To find out more, I invite you to read this article by Stanislas Marion published on Contrepoints .

I have no idea what a bitcoin will be worth in six days, six months or six years, but after more than three years of observation, I no longer doubt its durability. And even if another system eventually prevails, Bitcoin is and always will be the very first free and decentralized cryptocurrency. Would there be only the primacy to make the difference (there are many other things besides), it is a quality of which no other system will ever be able to prevail.

Beyond good and evil

Like the Internet, the existence and functioning of Bitcoin does not depend on the decision of any centralized organization but on the consensus of all those who contribute to make the network work.The rise of decentralized electronic currencies is a phenomenon to come to terms with and speaking out for or against bitcoin doesn’t make much sense. On the other hand, it is necessary to be aware of the qualities and the limits of these systems of a new kind.

Qualities

Bitcoin is collective and participatory

Due to its free and decentralized nature, Bitcoin is the first payment network that works solely thanks to its users and without a central authority. The project developers themselves cannot modify the protocol if their proposal is not adopted by the majority of users. Users have exclusive control of their fund.

Bitcoin is designed by and for the Internet

Bitcoin is made for the Internet and in the future will be able to offer concrete alternatives to several old, cumbersome and expensive systems. Bitcoin is not yet suitable for small transactions, but it already makes it possible to carry out compensation transactions or international transactions for a derisory cost when the amounts are large. The Bitcoin Lightning Network could promote micro-payments and open up electronic payment to markets hitherto not eligible due to cost structure. When the network is mature, we can also consider micro-payments in real life (payment by QR code with a mobile phone, for example).

Bitcoin protects individual rights and freedoms

Bitcoin allows everyone to securely store and exchange value on a network that cannot be seized, manipulated or stopped by any organization or individual. Thus giving free access to powerful tools that can play a role in the protection of individual rights and freedoms in dictatorships in particular.

Bitcoin is a Global and Neutral Currency

It is hard to find a currency in our history that has ever been free from political influence or national economics. Bitcoin is a universal currency that is even accessible to unbanked populations. It crosses all barriers between nations, policies and cultures.

Bitcoin is transparency

If the owners and recipients of bitcoin transactions remain unknown, all transactions are however public. Users can therefore choose to reveal their ownership of certain Bitcoin addresses to defined people. This allows any organization to implement excellent transparency practices adapted to each need.

Bitcoin Secures Assets

Through an ingenious use of cryptographic rules, Bitcoin offers an astonishing list of security-related features. Not only are Bitcoins impossible to counterfeit or spoof, but the protocol is also designed to be highly resilient against an impressive list of computer attacks, including distributed denial of service attacks. In addition with Bitcoin you free yourself from broadcasting your credit card number on the Internet.

Bitcoin saves

money Transactions are direct, no bank charges but network charges that are not proportional to the amount sent.This is particularly advantageous for large international payments.

Bitcoin protects against inflation

The amount of bitcoins generated is predicted in advance in the software and the maximum number will not exceed 21 million units. In addition, bitcoins lost by users will never be replaced.

Reviews

Method of bringing to market is questionable

Early adopters were well served but currently it is almost impossible to mine ( mine ) individual bitcoins. The only solution is to join a cooperative ( pool ) of miners and there – unless you have an expensive installation dedicated to this use and if possible to work at EDF – the income is absolutely derisory.

> Yes, the first ones who mined bitcoins were well rewarded, but that’s only fair. They believed in it before the others, when a bitcoin was worth almost nothing, and helped to install and then strengthen the network when it was still fragile. The deflationary and decentralized nature of the Bitcoin system, however, makes it completely alien to the mechanisms of a Ponzi scheme.

Buying bitcoins to spend them is absurd

To have bitcoins, the best and fastest way is to buy them. However, buying a currency in euros with the aim of spending it on the internet when you can pay directly in euros for most goods and services is a rather incongruous approach.

> Except that with Bitcoin Lightning Network the transaction fees are derisory and ultra-competitive compared to other means of payment such as bank cards or Paypal. In addition there are no additional costs for a purchase abroad. Finally, spending bitcoins ceases to be absurd when you have realized a capital gain, especially if it is substantial.

Bitcoin is volatile

The lucky holders of bitcoins do not (or rarely) use them to buy goods and services , but to exchange them for euros or dollars . Do not try to sell your bicycle in bitcoins on leboncoin , you will not find buyers. Bitcoin is still too volatile to trade, it is currently only a currency of speculators.

> Admittedly, Bitcoin remains very little used as a means of payment. That said, many businesses already accept bitcoins.

Bitcoin is a godsend for the mafias

Anonymous transactions, absence of controls and borders… for traffickers, Bitcoin combines the advantages of cash and those of online payment. Moreover, for the same reasons, it promotes money laundering and tax evasion.

> A kitchen knife can be used to kill… should we ban kitchen knives? La Poste is the main distribution network for illicit products sold on the “dark web”, yet we do not blame it for anything, why are we attacking the means of payment? Also banknotes, totally anonymous, issued by central banks remain by far the first means of payment for criminals around the world and yet paper money remains legal. Let us add that the anonymity of Bitcoin is very relative: the transactions are public and there is little anonymity when it comes to selling or buying bitcoins on the internet. This is how the police were able, after the fall of a network, to trace and seize the funds of many traffickers, which is impossible with paper money. Confidentiality and anonymity are only truly guaranteed by cryptocurrencies designed for this purpose. Over time the proportion of criminal activity on bitcoin has become marginal and absolutely derisory compared to the share of the underground economy in euros which could represent 10% of GDPin France. Finally, the relative anonymity also protects honest users against the totalitarian or imperialist behavior of certain States which are not very concerned about individual freedoms or which consider that their rights apply beyond their borders.

Bitcoin is not a trading currency

With a cap of 21 million, bitcoin will still have value but will be a currency in constant deflation. It is the opposite of a Keynesian logic which prefers that the money be spent as quickly as possible, even if it means going into debt to consume, rather than saving permanently. Under these conditions Bitcoin has little chance of becoming a dynamic currency like melting currencies and could forever remain an inert value, a vulgar investment.

> Bitcoin can also be a currency to spend: the price fluctuates a lot, buying bitcoins when they are cheaper and spending them when they are worth more is also an excellent strategy for regaining purchasing power. In addition, used as a payment intermediary, the value of this currency is irrelevant. In this use, we do not pay in bitcoins directly: the buyer’s account is debited in euros which are transformed into bitcoins. These bitcoins are then sent to the recipient and then transformed into euros. This is particularly interesting for a purchase abroad.

A hackable currency

Most people are not ready and not sufficiently trained to put their savings in a virtual wallet which, if we do not know how to secure it, can disappear overnight (death of the medium, loss of data, hacking …). Furthermore, the transactions are irreversible and there is no possible recourse.

> Bitcoin is unlike anything that came before it, so there is a culture to learn. But when you understand the principle, it is an extremely practical and very secure means of payment. It’s up to everyone to find the wallet that suits them best. As for the irreversibility of transactions, if we take the problem upside down, we can also consider that this is a particularly interesting aspect for online businesses.

An infinitely duplicable system

Bitcoin is free software, the system can be infinitely duplicated to manufacture other digital currencies at the risk of completely losing users and diminishing the interest of the concept.

> There are so many Bitcoin clones that few really stand out. Due to its value, the number of users and businesses that accept it, the computing capacity of its network of minors, Bitcoin has established itself as the leader of decentralized currencies.

Bitcoin allows only a very small flow of transactions

The Bitcoin network is unable to process more than seven transactions per second, a ridiculous volume for a technology with global ambitions. By way of comparison, Visa handles up to 47,000 transactions per second during peak hours.