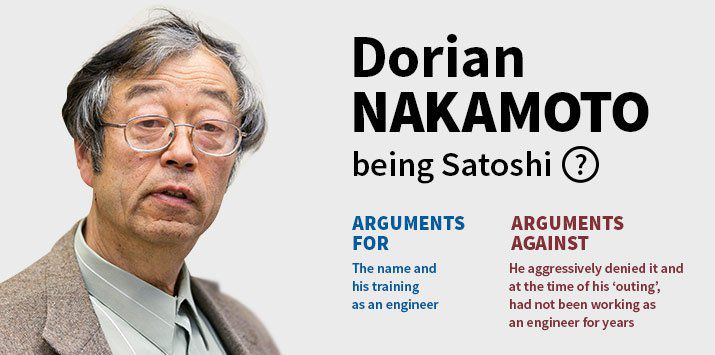

Bitcoin was invented in 2008 by a person or group called Satoshi Nakamoto. This pseudonym refers to Nakamoto himself, but it could also refer to a collective effort. He/they published the white paper describing his invention in January 2009, and announced the launch of bitcoin in October 2009.

The first decentralized cryptocurrency was Bitcoin. Bitcoin was launched in 2009 by a mysterious figure named Satoshi Nakamoto. Nakamoto described his creation as “a peer-to-peer electronic cash system.”

Cryptocurrencies are not backed by anything tangible like gold or silver. Instead, they use encryption techniques to secure transactions and verify ownership.

Crypto coins are usually based on open source software. They are distributed digitally, without being controlled by a single entity.

Since Bitcoin’s inception, hundreds upon hundreds of different crypto coins have been developed. Some are very similar to each other, while others are completely unique.

Best crypto to invest

Bitcoin has had a phenomenal rise in value since its inception in 2009. In fact, it has gone from being worth less than one dollar to becoming the second largest digital asset in the world. With a current market cap of almost $200 billion, it is now easily the biggest cryptocurrency in existence.

But how did Bitcoin achieve such success? And what does the future hold for it? Let’s take a look at some of the key drivers behind the growth of this revolutionary technology.

A cryptocurrency like Bitcoin is definitely a good investment if you’re thinking about investing in cryptocurrencies

Ethereum is another top cryptocurrency that saw significant growth in recent months, following its initial launch in 2015. After launching in 2015, the price of Ethereum rose steadily over the next few years, reaching new all-time high levels in December 2017.

Unlike Bitcoin, which is primarily used as a digital currency, Ethereum offers a platform that allows developers to build decentralized applications. Dapps offer many advantages over traditional apps, including faster transaction times, lower costs, and increased security.

The popularity of Ethereum has been driven by its ability to provide a platform for building dapps. This has led to a growing number of developers creating innovative projects on the Ethereum network. As a result, there are now thousands of different dapps running across the Ethereum network.

In 2018, we are likely see even more growth in Ethereum’s ecosystem, which could lead to further rises in the price of Ethereum itself.

In conclusion, I think that Ethereum will continue to grow in popularity due to its increasing utility as an application development platform. The combination of rising demand for Ethereum and falling supply should drive up prices significantly over the coming year.

How to invest in cryptocurrency

Cryptocurrency is becoming increasingly popular, especially among millennials. But what does that mean for investors? Is it safe? How much can I lose? And how do I actually buy crypto? These are some of the questions we’ll answer today.

First, let’s talk about volatility. Cryptocurrencies like Bitcoin and Ethereum are extremely volatile, meaning that their value changes frequently. In fact, the price of Bitcoin rose from $1,000 per coin to over $20,000 per coin in 2017 alone.

This makes it difficult to predict whether the value of your investments will go up or down – making it risky for most people to invest. Instead, many people choose to invest in exchange traded funds (ETFs), which are similar to mutual funds and give you exposure to several cryptocurrencies simultaneously. They’re less risky because they automatically track the overall performance of multiple currencies without giving you full control over each individual currency.

But even ETFs aren’t always easy to trade. Some exchanges don’t allow trading during certain times of day or require a lot of verification information upfront. Others won’t let you sell unless you’ve been holding for a while. So, it’s best to avoid buying into just one single cryptocurrency and spread out your investments across several coins.

Next, it’s important to diversify your portfolio. You don’t want to put all your eggs in one basket, so make sure you don’t invest too heavily in one particular coin. Diversification helps reduce risks and ensures that you don’t lose everything if something goes wrong.

Finally, you should do thorough research. There are scams everywhere, so make sure you find legitimate companies and follow the rules. Don’t invest more than you can afford to lose. Also, never send money you haven’t verified yourself.

Leave a Reply